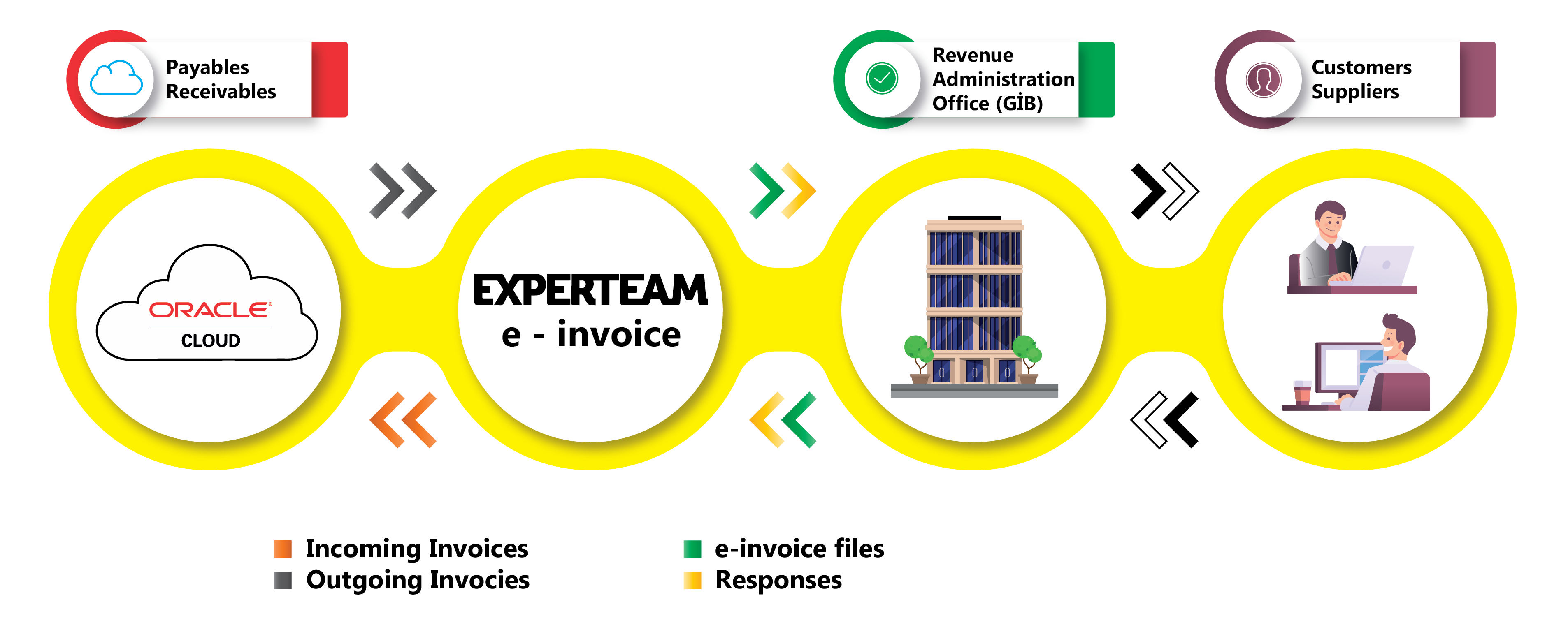

e-Invoice Application is the general name of the applications created to ensure the safe and healthy circulation of e-Invoices that comply with the defined standards between the parties.

e-Invoice Application is the general name of the applications created to ensure the safe and healthy circulation of e-Invoices that comply with the defined standards between the parties. With the publication of the Tax Procedure Law General Communiqué No. 397, the Electronic Invoice Application (e-Invoice Application) has been put into service. Within the scope of the communiqué published by the Revenue Administration on October 19, 2019, taxpayers whose 2018 or subsequent annual turnover exceeds 5 million TL are obliged to switch to e-Invoice application until July 1, 2020. Compared to the traditional invoice method, it allows you to manage your entire invoicing flow much faster, more efficiently and advantageously;